Contact Visa immediately at 1-800-449-7728

That could mean that a network outside of the credit union system is not online. Try using your Visa Debit Card as a "credit" and use the signature pad.

Contact Visa immediately at 1-800-449-7728

Voice Banking is available 24 hours per day. You can access Voice Banking by calling 804-262-8502.

Use our convenient and easy LocatorSearch tool to find your closest no-fee ATM.

Henrico Federal Credit Union is part of the Credit Union Service Center (CUSC) network. There are CUSCs all over the United States. You can do a quick search on the CUSC site to find the closest CUSC to you by visiting the Credit Union Service Center website.

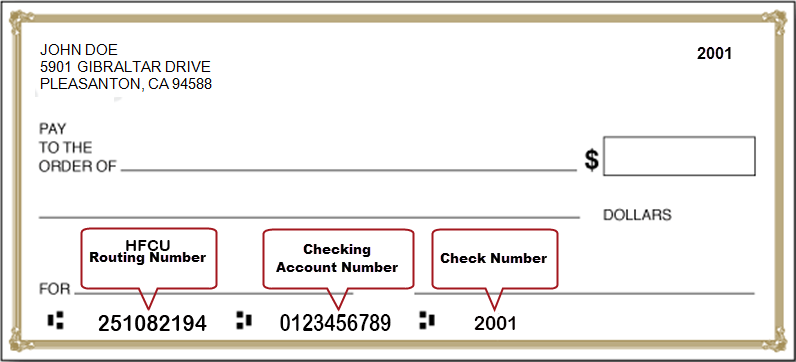

Henrico Federal Credit Union ABA routing number #251082194

Members using Mac computers will see the best results by using Google Chrome (rather than Safari) as their browser for home banking and bill pay. Download Google Chrome.

Call 804-266-0290 for assistance with Bill Pay

Emails and text messages can be masked to look like they are coming from a trusted sender when they are actually from someone else. You should never send personal information such as account numbers, social security numbers, passwords etc. via email or texting.

Never log in from a link that is embedded in an email message. Criminals can use fake email addresses and make fake web pages that mimic official webpages. To avoid falling into that trap, type the URL address directly in your web browser and then log in.

1. Don't reveal personal information via email. Emails and text messages can be masked to look like they are coming from a trusted sender when they are actually from someone else. Do not send personal information such as account numbers, social security numbers, passwords etc. via email or texting.

2. Don't download that file! Opening files attached to emails can be dangerous as they can allow harmful malware or viruses to be downloaded onto your computer. Make sure you have a recognized antivirus program (i.e. Symantec/Norton, McAfee, etc.) on your computer that is up-to-date. Most importantly, don’t open attachments from people you don’t know.

3. Log off from sites when you are done. When you are ready to leave a site you have logged in to, log off rather than just closing the page.

4. Monitor account activity. Monitor your account activity regularly either online or by reviewing your monthly statements and report any unauthorized transactions right away.

Henrico FCU offers three scholarships to members who are continuing their education. Use this link to find out more about these scholarships.

The services offered are similar, but the philosophies are very different. All credit unions are not-for-profit cooperatives. The owners of a credit union are the members. The owners of a bank are the stockholders.

All members are provided with a periodic statement. Years ago everyone received their periodic statements in the mail. Thanks to technology, you can receive that same periodic statement electronically; that's how eStatements were created. A periodic statement only shows activity for a set period of time (i.e., one month or one quarter).

You can also check for your most updated activity anytime through Digital Banking. This statement will show you the most recent information from your account.

Stolen mail falls under the jurisdiction of the US Postal Service. Contact your postal inspector and us as soon as possible.

Be extremely cautious. This notification is almost always fraudulent. You should report any suspicious activity to us right away.

A handy electronic share insurance calculator is available online to help members determine how to structure accounts to include joint accounts, payable upon death accounts, and others to receive greater coverage than the $250,000.

By operation of federal law, beginning January 1, 2013, funds deposited in a non-interest bearing transaction account will no longer receive unlimited coverage by the National Credit Union Administration (NCUA).

All accounts at Henrico FCU and Bellwood Credit Union, including all noninterest-bearing transaction accounts, will be insured by the NCUA up to the standard maximum share insurance amount of $250,000 for each deposit insurance ownership category. Individual Retirement Accounts (IRAs) continue to be insured separately.

Administered by the NCUA, the National Credit Union Share Insurance Fund (NCUSIF) is backed by the full faith and credit of the U.S. Government. For more information about the NCUA or the NCUSIF, visit www.ncua.gov.

Every time you use your card at an EMV chip-enabled terminal, the embedded chip generates a unique transaction code. This prevents stolen data from being fraudulently used.

You can use your card anywhere that accepts Visa® credit and debit cards.

You can use your card anywhere that accepts Visa® credit and debit cards.

No. There are no additional fees to use your EMV chip-enabled card.

To set up a direct deposit or draft from your checking account you will need the credit union aba routing number 251082194 and your checking account number.

All of this information can be found on the bottom of your checks. See the example below.

If you do not have checks contact the credit union at 804-266-0290 and press zero to speak with a representative.

To set up a direct deposit or draft from your savings account you will need the credit union aba routing number 251082194 and your member number.